Navigating Oklahoma Sales Tax: A Comprehensive Guide

Understanding sales tax regulations is crucial for businesses operating in Oklahoma. From tax rates to filing deadlines, compliance with state tax laws is essential to avoid penalties and ensure smooth operations. In this blog post, we'll delve into the details of Oklahoma sales tax, providing a comprehensive guide to help businesses navigate this aspect of their financial responsibilities.

Understanding Oklahoma Sales Tax

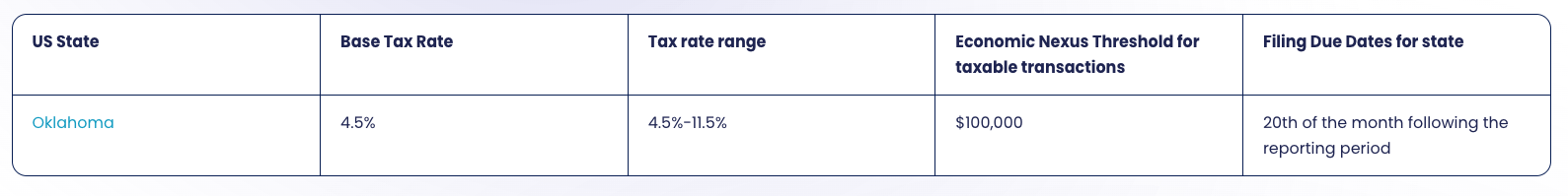

Sales tax in Oklahoma is imposed on the retail sale of tangible personal property and certain services. The tax rate varies depending on the location of the sale, with state, county, and local jurisdictions each levying their own taxes. Additionally, specific exemptions and special tax rates may apply to certain transactions, adding to the complexity of sales tax compliance.

Tax Registration

Businesses selling tangible personal property or taxable services in Oklahoma are required to register for a sales tax permit with the Oklahoma Tax Commission (OTC). This can be done online through the OTC's website. Once registered, businesses will be assigned a filing frequency based on their anticipated sales volume.

Filing Due Dates

Sales tax returns in Oklahoma are typically due on a monthly, quarterly, or annual basis, depending on the business's total sales tax liability. Monthly filers must submit their returns and remit taxes by the 20th day of the following month. Quarterly filers have until the 20th day of the month following the end of the quarter to file and pay taxes. Annual filers must file and remit taxes by January 20th of the following year.

Penalties for Non-Compliance

Failure to comply with Oklahoma sales tax regulations can result in significant penalties and interest charges. Businesses that fail to file returns or remit taxes on time may face penalties ranging from late fees to revocation of their sales tax permit. It's essential for businesses to stay organized and ensure timely filing and payment of sales taxes to avoid these consequences.

Navigating Sales Tax Resources

The Oklahoma Tax Commission provides various resources to help businesses understand and comply with sales tax regulations. The OTC's website offers guides, forms, and instructional materials to assist businesses in filing accurate and timely returns. Additionally, businesses can contact the OTC directly for personalized assistance with sales tax questions and concerns.

Navigating Oklahoma sales tax regulations can be challenging, but with the right knowledge and resources, businesses can ensure compliance and avoid costly penalties. By understanding registration requirements, filing due dates, and available resources, businesses can streamline their sales tax processes and focus on their core operations. Stay informed, stay compliant, and keep your business on the path to success in Oklahoma's dynamic marketplace.